8 min read

8 College Enrollment Marketing Tools for Your 2025 Strategy

The pressure is on. With the college admissions landscape in a season of tremendous change and a shrinking pool of students to reach via traditional...

Scoir is free for your students and for you. We also offer Advanced Solutions to help you better guide your students.

Access resources in the areas of test prep, essay support, and financial aid to better navigate every part of the admissions process.

Access Career Readiness for grades 6-8, built to help you guide students and track progress in the early years of career learnings and activities.

Scoir + Common App are integrating for the 2025-26 academic year!

Check out content and practical guides to help inform your enrollment strategies and programs.

Financial aid for college is available through several different sources. Understanding the types of financial aid sources is paramount in minimizing the cost of college.

According to the College Board’s Trends in Student Aid, $234.6 billion was provided in federal, state, and institutional grants in the 2021-2022 academic year.

Wondering how to get your hands on some of this money? You need to apply for the two main forms of financial aid: the FAFSA and the CSS Profile.

The FAFSA (which stands for the Free Application for Federal Student Aid), determines the aid eligibility a person is qualified to receive from the government to help pay for college.

There are a few important words in the title.

1. It is free to fill out. There is no reason to pay someone else to fill out your personal information on this document

2. This application is how the federal government determines whether someone is eligible for any type of aid, grant, or loan alike

3. Some colleges use the FAFSA to award their institutional aid

Completing the FAFSA qualifies you for several different types of aid. We've put together a helpful chart to help you understand the types of aid, along with examples.

| Type of Aid | Explanation of Aid | Examples |

| Federal Grants | Money that the federal government gives a student, which does not need to be paid back |

|

| State Grants | Money that the state government gives a student, which does not need to be paid back (Many states use the FAFSA to determine state grants. If your state is not on that list, check your state's financial aid administrator website to learn how to apply for state aid) |

|

| Low-Interest Federal Loans | Loans that are backed by the government and must be paid back over time |

|

| Work-Study | An aid program that enables students to work part-time to help pay for college expenses |

|

| State Loans | Available in some states |

|

| College/Institutional Loans | Loans offered directly through the college. Interest rates can vary |

|

| College/Institutional Grants and Scholarships | Grants and scholarships offered directly through the college that do not need to be paid back |

|

This blog post on Inside the Financial Aid Process explains more details about these terms and the types of aid that are available to you.

Everyone should fill out the FAFSA, whether you need help paying the majority of your college tuition or you need to secure low-interest loans. Even if you think you might not qualify for grants based on your financial situation, you should still fill out the FAFSA to qualify for low-interest federally-backed student loans, which are available to students with and without financial need.

The CSS Profile is used to determine a student's eligibility for institutional aid and is used by approximately 250 schools. While these schools also use the FAFSA to provide aid from the government, the CSS Profile is used by these specific colleges to give out grants, scholarships, and loans directly. The CSS Profile is administered by the College Board, which states: "Each year CSS Profile unlocks access to grant aid over $9 billion for thousands of students."

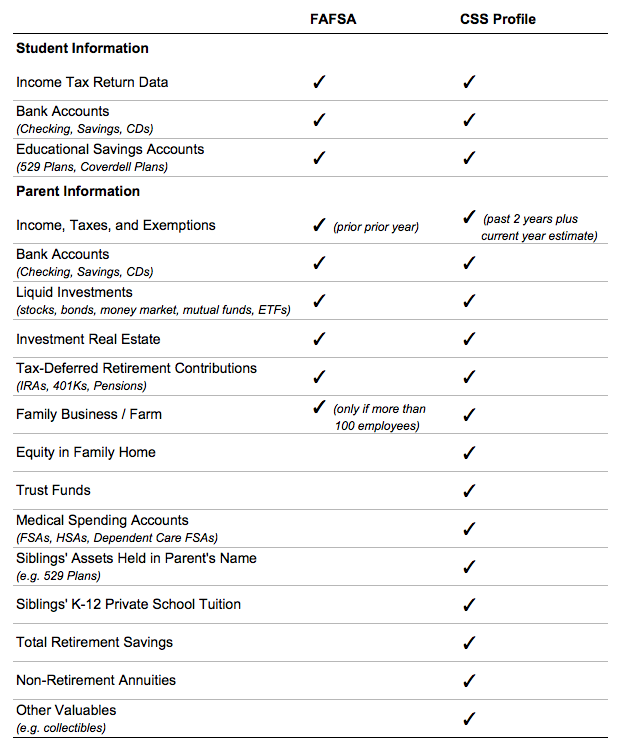

In addition, the CSS Profile more closely examines a family's financial situation to award aid to students with the most financial need. The chart below explains the assets, savings, and other financial information that FAFSA and the CSS Profile consider.

* Not every college that uses the CSS Profile takes all of these additional factors into consideration.

If you are applying to one of these 250ish schools, you need to fill out both the FAFSA (for federal and state aid) and the CSS Profile (for institutional aid). Before filling out the CSS Profile, it might be helpful to read this article that explains answers to common questions about the CSS Profile.

Your CSS Profile will be in your College Board account. If you've taken an AP, PSAT, or SAT test, you will already have an account.

Sign in to your College Board account, then navigate to this CSS Profile page to get started.

While the FAFSA is free, the CSS Profile costs money: $25.00 for the first college and $16.00 for each additional. Therefore, if you are applying to 8 colleges that require the CSS Profile, it will cost $137.00.

That said, on December 14, 2017, The College Board announced that "starting in fall 2018, CSS Profile will also allow an unlimited number of CSS Profile applications for first-time, domestic college applicants who take the SAT with a fee waiver or meet income-eligibility criteria."

Double-check if you need to submit any additional paperwork with each college to which you're planning to apply or have already applied.

After the FAFSA is completed, the government will determine your Student Aid Index (SAI). The SAI was previously the Expected Family Contribution, which was replaced with the SAI in December 2023. The SAI uses the Federal Method, which is determined by your financial information. Your SAI is not what you will have to pay for tuition! Rather, your SAI is a government formula that provides colleges with an indication of what you can afford.

Within 5 days of filling out the FAFSA, you should receive your Student Aid Report (SAR). In this report, you'll find your SAI and your Data Release Number (DRN), which is required for any changes to your FAFSA. If the information on your SAR is correct, your FAFSA is complete. Keep a copy of the SAR for your records.

Please note that the FAFSA is rolled out new changes for the 2024-2025 academic year.

Colleges that use the CSS Profile in addition to FAFSA calculate a student's SAI by using the Institutional Method, which will likely arrive at a different number from the Federal Method because the CSS Profile takes into consideration more financial information.

The College Board further clarifies that "the FM (Federal Method) is used to calculate the student's eligibility for federal aid, such as Pell Grants, and most types of state aid. It's used by most public universities. Many private colleges and scholarship programs and some public universities use the IM (Institutional Method) to determine the student's eligibility for their own grant funds." Scoir students can work alongside their parents/guardians to use the provided calculator to determine an estimated SAI.

The cost of attendance is a combination of tuition, room and board, books, travel, and personal expenses. Let's look at 3 scenarios for a student whose SAI is $15,000.

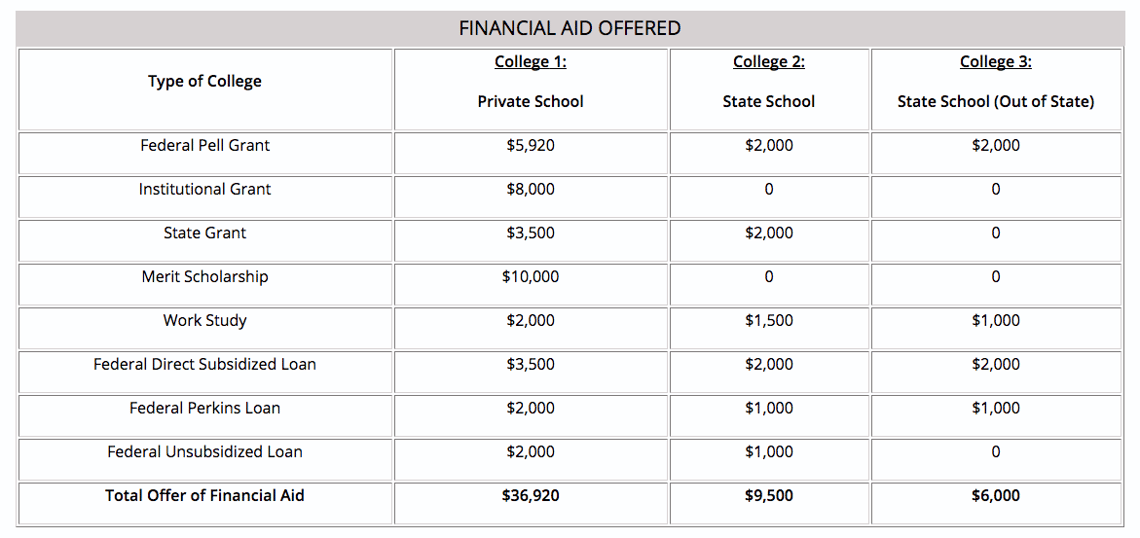

Let's understand these numbers a little better. Remember, in all 3 situations, the financial need numbers assume the student is paying $15,000 out of pocket. Now, each of these schools can decide how it might help meet a student's need using the school's financial aid. We explore each potential scenario below.

Once a student’s financial need is determined, each college will present a Financial Aid Award Letter, which will show the grants, scholarships, work-study, and loans offered to help pay for college. Some colleges (such as colleges 1 and 2 above) will attempt to offset a good portion of the need, other colleges (such as college 3 above) may attempt to offset some needs, and others may not offer any assistance at all.

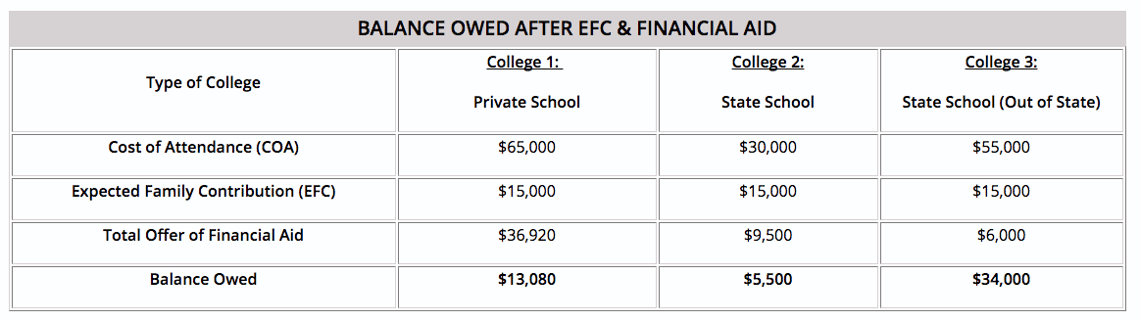

Now that we've learned the financial aid amount each college offers, let’s look at what will be owed.

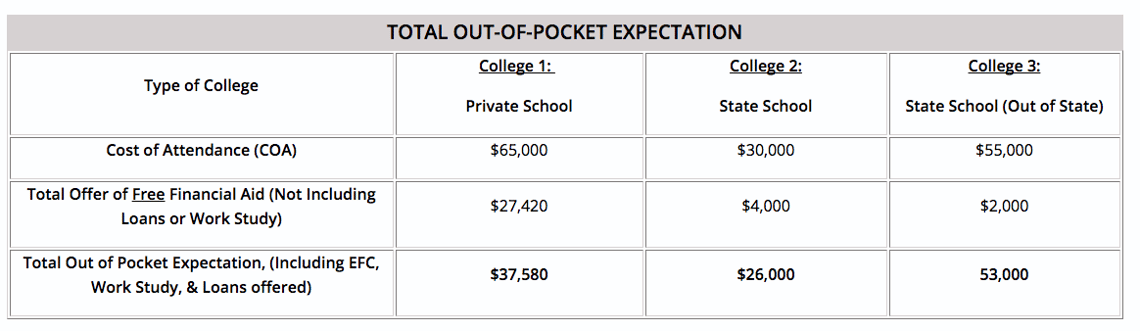

Let’s look at these numbers a bit differently. Since the SAI is a number that the colleges assume a student can pay, here are the total out-of-pocket expenses for a student, if they accept the total financial aid award, including loans, which have to be paid back, and work-study, which have to be earned.

Since most colleges award their financial aid on a first-come, first-served basis, it's best to fill out the FAFSA and CSS Profile as close as possible to October 1 each year.

Many colleges and universities have financial aid application deadlines throughout January and February. Go directly to the school's website to learn their financial aid deadlines.

The U.S. Department of Education's website lists student aid deadlines by state. While some say "as soon as possible after October 1st," most others have specific dates, which could be as early as mid-January. If your state is not listed on this FAFSA form, then you need to research your state's application policy and deadline by looking up your state's financial aid administrator website.

This article was originally published on October 2, 2021. It was updated on July 30, 2024 for accuracy and comprehensiveness.

8 min read

The pressure is on. With the college admissions landscape in a season of tremendous change and a shrinking pool of students to reach via traditional...

19 min read

This blog post was provided by Test Innovators, our test prep partner. You can learn more about Test Innovators on our partners page.

6 min read

When it comes time to think about college, it’s important to slow down and consider why you'd like to attend college and engage in conscious...